This report has been updated. Click here to view latest edition.

If you have previously purchased the archived report below then please use the download links on the right to download the files.

Automotive Radar 2020-2040: Devices, Materials, Processing, AI, Markets, and Players

ADAS and autonomous driving, 4D imaging radars, semiconductor technology, low insertion loss materials, advanced packaging, deep learning, object detection/classification/tracking

Show All

Description

Contents, Table & Figures List

Pricing

Related Content

This report investigates the market for radar technology, specifically focusing on automotive applications. It develops a comprehensive technology roadmap, examining the technology at the levels of materials, semiconductor technologies, packaging techniques, antenna array, and signal processing. It demonstrates how radar technology can evolve towards becoming a 4D imaging radar capable of providing a dense 4D point cloud that can enable object detection, classification, and tracking.

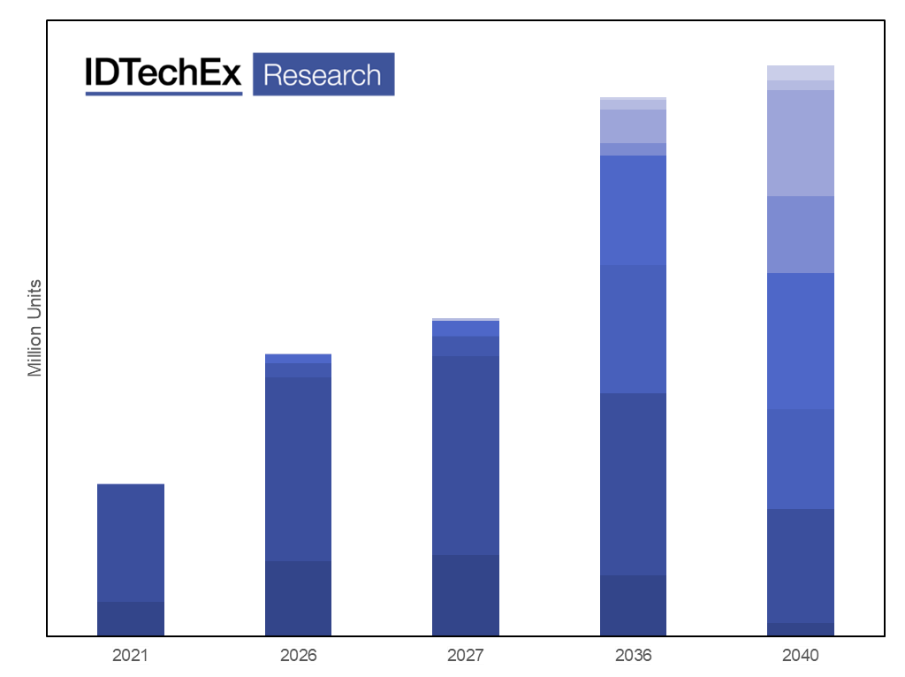

The report examines the latest product innovations. It identifies and reviews promising start-ups worldwide. The report builds a short- and long-term forecast model covering the period between 2019 to 2040. The market- in unit numbers and value- is segmented by the level of autonomy and by passenger vehicles, shared vehicles, and trucks. In the first decade, ADAS (level 1 and 2) will be the primary market drivers whilst in the second decade autonomous vehicles will be.

Introduction

Radars are a key element of the sensor suite in ADAS and autonomous mobility. This report first examines the role that radars play in various ADAS functions such as ACC, AEB, FCA, BSD, LCW, HWA, and so on. It then examines how the radar content per vehicle- both for short/medium and long-range radars- will increase with increasing ADAS and autonomy level.

The report then examines the drivers and trends in operational frequency worldwide. It examines how device parameters- including centre frequency, bandwidth, measurement time, and virtual aperture- affect key performance indicators (KPIs) such as velocity, range, azimuth, and elevation resolution. The common products on the market today are then reviewed and benchmarked. The value chain- from chip (fabless/IDM/foundry) to module makers is outlined.

Detailed market forecast models are built. These market forecasts first consider how ADAS and autonomy will penetrate into the vehicle market. Here, the report will build a twenty-year market forecast (2020 to 2040), segmenting the vehicle market by level 0 to 5 of autonomy. The forecast model also considers the impact of robotaxis and shared autonomous vehicles on total vehicle sales, predicting peak car sales around 2031/2 in a moderate scenario. These forecasts are built in conjunction with our autonomous mobility team. The forecasts are then converted into radar unit sales. To arrive at market value, we develop a moderate and an aggressive price reduction scenario for short/medium and long-range radars. We also develop forecasts by the semiconductor technology (GaAs, SiGe, and Si).

Unit number market forecasts segmented by the ADAS level and autonomous mobility level. The report also provides forecasts for vehicle and truck numbers segmented by autonomy level as well as radar forecasts in value based on different cost evolution scenarios.

Technology trends: semiconductors, on-chip integration, packaging, and low-loss materials

The radar technology is changing. Indeed, these are very exciting times for radars. We offer a detailed quantitative benchmarking of various semiconductor technology options such as GaAs HEMT, InP HEMT, SiGe BiCMOS, Si CMOS, and Si SOI. We consider maximum frequency, amplifier efficiency, lithographic technology node, function integration capability, volume, and cost.

The report shows how the semiconductor technology has evolved and is likely to evolve in the coming years. It shows how and when GaAs technology gave way to SiGe and how now SiGe might be beginning to give away to Si CMOS (or SOI). It offers a detailed overview of key existing and emerging products on the market covering SiGe BiCMOS as well as Si CMOS and SOI. Here, we consider companies such as NXP, Infineon, ST Microelectronics, ON Semiconductor, Texas Instruments, Analog Devices, Arbe Robotics, Uhnder, Steradian, Oculii, and so on.

The shift towards Si CMOS and similar will enable more function integration into radar chips. Indeed, we show how radars have evolved from having a separate chip for each function to single-chip radars. The latest SiGe BiCMOS and some recent Si CMOS radar chips include multiple transceivers, monitoring functions, waveform generators, and an ADC. The latest Si CMOS generations even include a microcontroller with memory as well as a digital signal processing unit (DSP). This clearly shows the trend towards single-chip solutions which will result in significant cost-reduction and volume-production potential.

Packaging solutions are next considered. In the past, multiple dies were directly mounted on the board (CoB) and wire-bond connected. Today, the chips are packaged using wafer-level-packaging technologies, e.g., WLP-BGA, or flip-chip ball-grid-array (BGA). We provide a benchmarking of discreet die vs packaged solutions. Within packaged solutions, we also compare the high-frequency behaviour of flipchip, fan-out and BGA.

Board-level trends in design, material, and passives are then examined. Here, we see how the board arrangement has evolved. In the past two separate RF and digital boards were utilized. Now, a hybrid board in which the top layer is composed of a special RF material is common. The trend- at least for small antenna array sizes- is to go towards antenna-in-package (AiP) designs. Some such designs are already qualified for automotive use. The long-term possibility of antenna-in-chip in the longer term is explored.

The material requirements for low insertion loss at high frequencies are analysed. These special materials will need to offer low loss tangents. Crucially, the dielectric constant and the loss tangent will need to remain stable against variations in temperature and frequency. Furthermore, moisture uptake will need to be low and the material will need to be easy- or with well-known modification- processible, e.g., how to make the Cu stick. This study offers a comprehensive benchmarking of a wide range of materials on the market including ceramic-filled PTFEs, LCP, PI/fluoropolymers, ceramics such as LTCC or AlN, glass, etc.

Towards 4D imaging radars

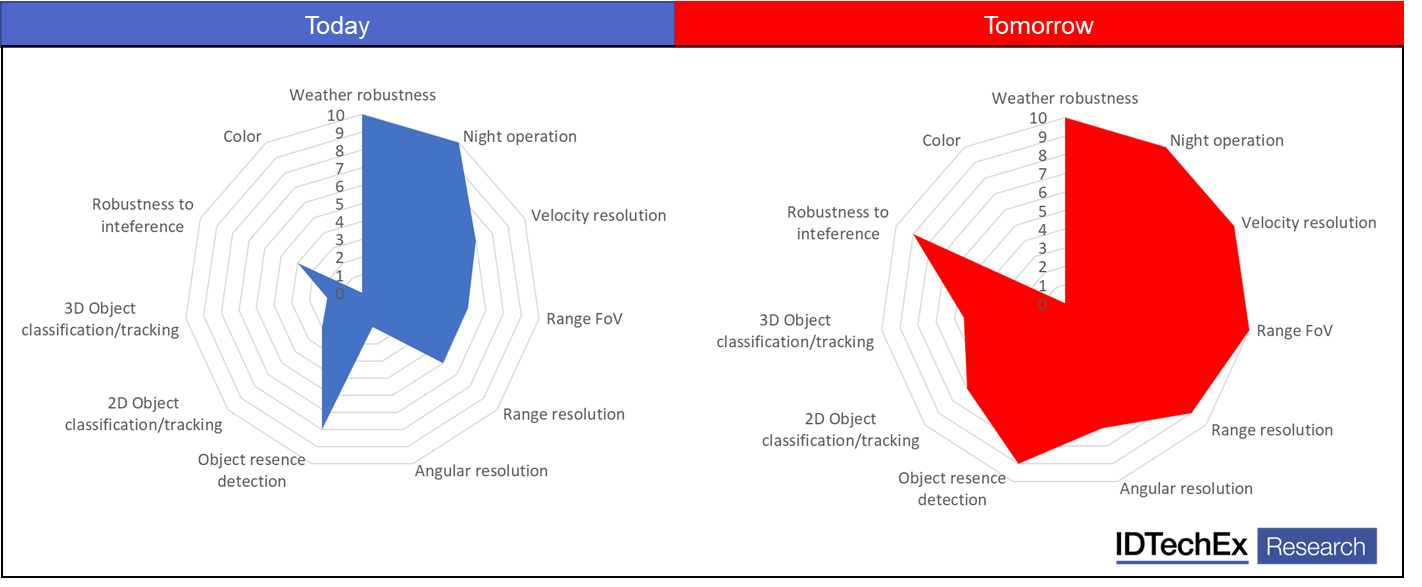

Radar technology is further evolving towards a 4D imaging radar capable of providing a dense 4D point cloud that can enable moving beyond presence, range, and speed determination towards 3D object detection, classification, and tracking.

We highlight and assess the critical impact of increasing the antenna array on azimuth and elevation resolution and on the data matrix and the point cloud. The additional high-res information on azimuth and elevation paves the way towards 4D imaging radars. These emerging capabilities will blur the lines with lidar, potentially allowing radar to encroach into lidar territory without compromising its light-level and weather independence. This will set up an interesting competitive dynamic although lidar will likely retain its dominance some parameters including angular resolution and potentially object classification.

The report offers a high-level review of deep neutral network and deep learning techniques which have been so successful in camera images. The challenges specific to radar data are considered. In particular, we consider how future radars can densify the radar point cloud, bringing its density closer to the point clouds of lidars. We consider the state-of-the-art in 2D and 3D object detection, and outline some approaches aimed at bridging the performance gap between the two. We discuss the challenge of the limited availability of labelled training data, and how some are seeking to build precise radar maps and to develop semi-automated methods of labelling radar data, often using some late-state fusion with data from cameras, GPS and lidars.

The interference challenges are also briefly discussed. This is expected to become a growing challenge as the number of radar-equipped radars on the roads will grow. Various approaches are under consideration. In some cases, the jammed signals are locally reconstructed. In other approaches, a loose or a tight system-level coordination is proposed, akin to what is found in telecommunication systems.

These radar charts compare the status of today's radar with that which is emerging.

Innovative start-ups

Multiple innovative radar start-ups have emerged in recent years. These firms take different approaches. Some are developing radars on advanced SOI or CMOS nodes, supporting very large virtual channel sizes. This, coupled with their developing processing techniques, can enable truly 4D imaging. Others are developing novel techniques such as the use of metamaterials to electronically steer the radar beam.

Not all are automotive focused. Indeed, some are focused on the UWB band, seeking to offer single-chip low-cost high-resolution radar solutions for applications such as drone navigation, vital signs monitoring, human machine interface, medical imaging, smart home, and so on. These start-ups include Arbe Robotics, Uhnder, Steradian, Echodyne, Metawave, Oculii, Vayyar, Lunewave, Zendar, Ghostwave, Novelda, Omniradar (Staal Technologies), and so on.

Market forecasts

Detailed market forecast models are built. We consider the diffusion of different levels of ADAS and autonomy into the vehicle market over a twenty-year period. We have selected this long timeframe because higher levels of autonomy will take time to become technologically ready and commercially viable.

Our model, therefore, offer a twenty-year unit number forecast (2020 to 2040), segmenting the vehicle market by level 0 to 5 of autonomy. This model clearly shows that how level 0 will tend towards obsolescence before the 2032-2034 period. It shows how level 1 will slowly give way to ADAS level 2, enabling this level to become the dominant level of automation in the short and medium terms.

Our model then considers the rise of higher levels of autonomy (level 3, 4, and 5). In particular, it considers the impact of shared autonomous vehicles and robotaxis on total demand for vehicles, showing that a peak car sales scenario can be anticipated in 2031/2. The comes about because a shared vehicle can service a higher mileage of travel demand than a private vehicle. The total vehicles sales are then forecast to fall beyond this point, creating complex and far-reaching questions for the global automotive industry.

We translate our vehicle and truck unit number forecasts into radar units. Here, we consider the radar content- for short/medium and long-range radars- per vehicle for each level of autonomy. The increase in radar content per vehicle will compensate for the emergence of peak-car. We also develop market value forecasts, considering a moderate and an aggressive price erosion scenario for short/medium and long-range radars.

Finally, we also segmented the unit number forecasts by semiconductor technology, showing how a technology transition has already taken place and how we are at the starting phase of another technology replacement round.

Analyst access from IDTechEx

All report purchases include up to 30 minutes telephone time with an expert analyst who will help you link key findings in the report to the business issues you're addressing. This needs to be used within three months of purchasing the report.

Further information

If you have any questions about this report, please do not hesitate to contact our report team at research@IDTechEx.com or call one of our sales managers:

ASIA: +82 10 3896 6219

| 1. | INTRODUCTION |

| 1.1. | Towards more comfortable, safer and more autonomous vehicles |

| 1.2. | Towards ADAS and Autonomous Driving: increasing sensor content |

| 1.3. | Towards ADAS and Autonomous Driving: increasing radar use |

| 1.4. | SRR, MRR and LRR: Different functions |

| 1.5. | The evolving role of the automotive radar towards full 360deg 4D imaging radar |

| 1.6. | Automotive radars: role of legislation in driving the market |

| 1.7. | Automotive radars: frequency trends |

| 1.8. | Radar: which parameters limit the achievable KPIs |

| 1.9. | Impact of frequency and bandwidth on angular resolution |

| 1.10. | Why are radars essential to ADAS and autonomy? |

| 1.11. | What is sensor fusion? |

| 1.12. | Towards autonomy: Increasing semiconductor use |

| 1.13. | Performance levels of existing automotive radars |

| 1.14. | Radar players and market share |

| 1.15. | Radar market forecasts (2020-2040) in all levels of autonomy/ADAS in vehicles and trucks (unit numbers) |

| 1.16. | Radar market forecasts (2020-2040) in all levels of autonomy/ADAS in vehicles and trucks (market value) |

| 1.17. | Radar semiconductor market share forecast (GaAs, SiGe, Si) |

| 2. | SEMICONDUCTOR TRENDS |

| 2.1. | Ten year (unit number) market forecasts for automotive radars |

| 2.2. | Benchmarking of semiconductor technologies for mmwave radars |

| 2.3. | The choice of the semiconductor technology |

| 2.4. | SiGe: current and emerging performance levels |

| 2.5. | SiGe: overview and comparison of manufacturers |

| 2.6. | SiGe BiCMOS: Infineon Technology |

| 2.7. | SiGe BiCMOS: NXP (Freescale) Technology |

| 2.8. | SiGe BiCMOS: ST Microelectronics |

| 2.9. | A closer look at SiGe vs Si CMOS |

| 2.10. | Emerging all Si CMOS radar IC packages: NXP |

| 2.11. | Emerging all Si CMOS radar IC packages: ADI |

| 2.12. | Emerging all Si CMOS radar IC packages: TI |

| 2.13. | Many chip makers are on-board |

| 3. | PACKAGING TRENDS |

| 3.1. | Packaging trends: from discreet bare die (COB) to wafer-level packaging and beyond? |

| 3.2. | Packaging trends: AiP goes commercial? |

| 3.3. | Packaging trends: from discreet bare die (COB) to wafer-level packaging and beyond? |

| 3.4. | Comparison of die vs packaged options |

| 3.5. | eWLP vs flip chip and BGA in terms of insertion loss |

| 3.6. | Radar packaging: Material opportunities |

| 3.7. | Glass and panel level packaging of radars? |

| 3.8. | Function integration trend: from discreet to full chip-level function integration |

| 3.9. | Function integration trends: towards true radar-in-a-chip |

| 3.10. | Evolution of radar chips towards all-in-one designs |

| 4. | BOARD-LEVEL TRENDS AND OPPORTUNITIES |

| 4.1. | Board trends: from separate RF board to hybrid to full package integration? |

| 4.2. | Hybrid board is the norm |

| 4.3. | Hybrid board: what is it |

| 4.4. | Packaging trends: AiP goes commercial? |

| 5. | MATERIAL REQUIREMENTS FOR LOW INSERTION LOSS |

| 5.1. | Overview of the high level requirements for high frequency operation |

| 5.2. | Interconnect design for high frequency electronics |

| 5.3. | Passives: scaling challenges with frequency |

| 5.4. | Passives: transition towards embedded |

| 5.5. | Effect of low dielectric constant (I): feature sizes |

| 5.6. | Effect of low dielectric constant (II): thinness |

| 5.7. | Thinning the substrate at high frequencies: the challenge |

| 5.8. | Dielectric constant: benchmarking different substrate technologies |

| 5.9. | Dielectric constant: stability vs frequency for different organic substrates (PI, PTFE, LCP, thermosets, etc.) |

| 5.10. | Dielectric constant: stability vs frequency for different inorganic substrates (LTCC, glass) |

| 5.11. | Loss tangent: benchmarking different substrate technologies |

| 5.12. | Loss tangent: stability vs frequency for different substrates |

| 5.13. | Dielectric constant and loss tangent stability: behaviour at mmwave frequencies and higher |

| 5.14. | Temperature stability of dielectric constant: benchmarking organic substrates |

| 5.15. | Temperature stability of dielectric parameters of HTCC and LTCC alumina |

| 5.16. | Moisture uptake: benchmarking different substrate technologies |

| 5.17. | AlN vs other HTCC and LTCC materials |

| 6. | OTHER TRENDS |

| 6.1. | Key trends: from semiconductor to packaging to board technologies |

| 6.2. | Other trends: moving beyond just object detection |

| 6.3. | Other trends: increasing range, angular and elevation resolution |

| 6.4. | Towards large radar MIMO |

| 6.5. | Other trends: blurring the boundary between radar and lidar |

| 7. | SIGNAL PROCESSING |

| 7.1. | From assisted driving radar to radars for highly-autonomous driving |

| 7.2. | Operational mechanism and data sets of a FMCW radar |

| 7.3. | Signal processing path from front-end to data-output with range, velocity, presence, etc. map |

| 7.4. | FFTs to extract range, velocity, and object presence maps |

| 7.5. | Radar: how to measure the angle |

| 7.6. | Self-localization using radars |

| 7.7. | Map localization in maps using radar for path planning |

| 7.8. | Terminologies explained: AI, machine learning, artificial neural networks, deep neural networks |

| 7.9. | Radar data and processing: will it impact the value chain? |

| 7.10. | What we mean by object detection, identification, and tracking? |

| 7.11. | Radar : identification challenge |

| 7.12. | Artificial intelligence: waves of development |

| 7.13. | Classical method: feature descriptors |

| 7.14. | Typical image detection deep neutral network |

| 7.15. | Algorithm training process in a single layer |

| 7.16. | Towards deep learning by deepening the neutral network |

| 7.17. | The main varieties of deep learning approaches explained |

| 7.18. | How good is 2D object detection today? |

| 7.19. | What is the status of 3D object detection? Why it lags behind? |

| 7.20. | Towards 3D object detection: fused 2.5D networks |

| 7.21. | Deep neutral networks for radar data processing |

| 7.22. | Radars: the trade-off between speed and pre-processing of data (vs raw data) |

| 7.23. | Radars: the choice of system architecture and the choice of pre-processing of data |

| 7.24. | Data transfer speed: pre- or post-process radar data? |

| 7.25. | Radar data: challenges of spare point cloud |

| 7.26. | Data fusion challenge: mismatch in point cloud densities |

| 7.27. | Training neutral networks on radar data: the labelling challenge |

| 7.28. | Automatic data labelling: early fusion of camera, lidar and radar data |

| 7.29. | Developing ground truth and training data for data fusion and deep learning (including radar data) |

| 7.30. | Astyx Dataset HiRes2019 |

| 7.31. | Resolving the positional uncertainty in reference camera images |

| 7.32. | Radar object classification: using target-level data only |

| 7.33. | Radar object classification: using target-level data only and doing classification on clusters |

| 7.34. | Radar object classification: combining raw radar cube data with target-level data to improve performance |

| 8. | INTERFERENCE MITIGATION |

| 8.1. | Interference challenge |

| 8.2. | Known mitigation approaches for radar interference |

| 9. | PROMISING START-UPS |

| 9.1. | Uhnder: digital automotive radar-on-a-chip |

| 9.2. | Arbe |

| 9.2.1. | Arbe Robotics: high-performance radar with trained deep neutral networks |

| 9.2.2. | Arbe Robotics: high-performance 4D radar imaging |

| 9.3. | Metawave |

| 9.3.1. | Metawave: mmwave electronically steerable radar |

| 9.3.2. | Metawave: the hybrid beam forming architecture |

| 9.3.3. | Metawave: the hybrid beam forming architecture |

| 9.3.4. | Metawave: high interference mitigation capabilities |

| 9.3.5. | Metawave: high angular resolution at long range with electronically scanned high-frequency radar beams |

| 9.3.6. | Metawave: deep learning and fusion with other sensor data |

| 9.4. | Imec |

| 9.4.1. | Imec: In-cabin monitoring and gesture recognition using 145GHz radar |

| 9.5. | Steradian Semi: start-up developing 4D radar |

| 9.6. | Kymeta: metamaterials satellite antenna |

| 9.7. | Echodyne: Metamaterial Electronically Scanning Array |

| 9.8. | Metawave: using metal material to do beam forming with low side lobes |

| 9.9. | Zendar: high-res imaging radar for automotive |

| 9.10. | Vayyar: massive MIMO single-chip UWB radar solution |

| 9.11. | Neteera: 122GHz Si-based antenna-integrated single-package solution |

| 9.12. | Novelda AS: lower-power UWB radar for occupancy and respiration sensing |

| 9.13. | Oculli: towards 4D imaging radar |

| 9.14. | Omniradar (Staal Technologies): single chip 60GHz radar |

| 9.15. | Lunewave: 360deg azimuth view using 3D printed Lineburg lens |

| 9.16. | General Radar Corp: short to long range 3D scanning radar for the 76~81GHz automotive radars |

| 9.17. | Silicon Radar GmbH: radar chip design on SiGe BiCMOS |

| 9.18. | GhosWave: minimising mutul radar interference |

| 9.19. | Smartmicro GmbH |

| 9.20. | InnoSent GmbH |

| 10. | MARKET ANALYSIS |

| 10.1. | ADAS (level 1 and 2) |

| 10.1.1. | Towards more comfortable, safer and more autonomous vehicles |

| 10.1.2. | Towards ADAS and Autonomous Driving: increasing radar use |

| 10.1.3. | Regulation pushing adoption of ADAS 1 and 2 |

| 10.1.4. | Market forecasts (2020 to 2040) for ADAS and autonomous driving (level 3, 4, and 5) in passenger vehicles and robotaxis |

| 10.1.5. | Radar forecast (2020-2040) in ADAS level 1 and 2 |

| 10.2. | Autonomous private passenger cars and robotaxis (levels 3, 4, and 5) |

| 10.2.1. | Why autonomous cars |

| 10.2.2. | Challenges to traditional OEMs |

| 10.2.3. | Future mobility scenarios: autonomous and shared |

| 10.2.4. | Product and value positioning of autonomous cars |

| 10.2.5. | OEMs are becoming mobility service providers |

| 10.2.6. | What are the levels of automation in cars |

| 10.2.7. | The automation levels in details |

| 10.2.8. | Functions of autonomous driving at different levels |

| 10.2.9. | Roadmap of autonomous driving functions |

| 10.2.10. | Two development paths towards autonomous driving |

| 10.2.11. | Autonomous driving is changing the automotive supply chain |

| 10.2.12. | Auto OEMs' partnerships in autonomous driving |

| 10.2.13. | Overview of autonomous car launch time by OEMs |

| 10.2.14. | AV testing distance in California by companies |

| 10.2.15. | Waymo leading the game in terms of disengagement rate |

| 10.2.16. | AV testing by auto OEMs in 2018 |

| 10.2.17. | Autonomous driving test in Beijing, China |

| 10.2.18. | Autonomous driving in China: from testing to pilot services |

| 10.2.19. | OEMs are becoming mobility service providers |

| 10.2.20. | Mobility services launched by auto OEMs |

| 10.2.21. | Mobility service cost: autonomous vs non-autonomous |

| 10.2.22. | Overview of robotaxi launch time announced by AV companies |

| 10.2.23. | Travel demand and mobility as a service (MaaS) |

| 10.2.24. | Passenger car sales will peak earlier than expected |

| 10.2.25. | Passenger car sales forecast 2020-2040 - moderate |

| 10.2.26. | Global autonomous passenger car sales forecast 2020-2040 |

| 10.2.27. | Radar market forecasts (2020-2040) in all levels of autonomy/ADAS in vehicles and trucks (unit numbers) |

| 11. | AUTONOMOUS TRUCKS |

| 11.1. | Pain points in the trucking industry |

| 11.2. | Why autonomous trucks? |

| 11.3. | Automation levels of trucking explained |

| 11.4. | Funding race for autonomous truck start-ups |

| 11.5. | Announced deployment of L4+ autonomous trucks |

| 11.6. | Major stakeholders in autonomous trucking |

| 11.7. | Market readiness level of L4+ autonomous truck companies |

| 11.8. | Evolving autonomous applications for trucks |

| 11.9. | What is truck platooning? |

| 11.10. | Market share forecast for autonomous trucks 2020-2040 |

| 11.11. | Radar market forecasts (2020-2040) in all levels of autonomy/ADAS in vehicles and trucks (unit numbers) |

| 12. | MM-WAVE 5G: BEAM FORMING TECHNOLOGIES, ARCHITECTURES, AND ICS |

| 12.1. | Motivation of 5G: increasing the bandwidth |

| 12.2. | 5G station installation forecast by frequency |

| 12.3. | Shift to higher frequencies shrinks the antenna |

| 12.4. | Solving the high power loss at high frequency challenge: High antenna gain increases distance |

| 12.5. | Solving the high power loss at high frequency challenge: High antenna gain increases distance |

| 12.6. | Choice of semiconductor at high frequencies |

| 12.7. | Antenna array: can we do it with silicon(SiGe BiCMOS or Si CMOS) even in macro base stations? |

| 12.8. | Major technological change: from broadcast to directional communication |

| 12.9. | Solving the high power loss at high frequency challenge: FEMTO AND PICOCELLS |

| 12.10. | Analog vs Digital Beam Forming |

| 12.11. | Hybrid beamforming |

| 12.12. | Planar vs non-planar antenna array designs |

| 12.13. | Mobile phone (receiver) vs base station architecture |

| 12.14. | The common Quad structure found in Satcom |

| 12.15. | Example from satellite and phased-array radar: 768-ement array |

| 12.16. | Example from satellite and phased-array radar: 256-element Ku-band SATCOM |

| 12.17. | IDT (Renesas) has a strong position in beam-forming ICs |

| 12.18. | IDT (Renesas) 28Ghz 2x2 4-channel SiGe beamforming IC |

| 12.19. | NXP: 4-channel Tx/Rx beamforming IC in SiGe with low EVM |

| 12.20. | 28GHz all-silicon 64 dual polarized antenna |

| 12.21. | Anokiwave: Tx/Rx 4-element 3GPP 5G band all in silicon |

| 12.22. | Anokiwave: 256-element all-silicon array |

| 12.23. | Sivers IMA: dual-quad 5G dual-polarized beam forming IC |

| 12.24. | Analog: a 16-channel dual polarized beam-forming IC? |

| 12.25. | SoC Microwave: single-channel GaAs HEMT devices |

Report Statistics

| Slides | 258 |

|---|---|

| Forecasts to | 2040 |