Impacts on UK car sales

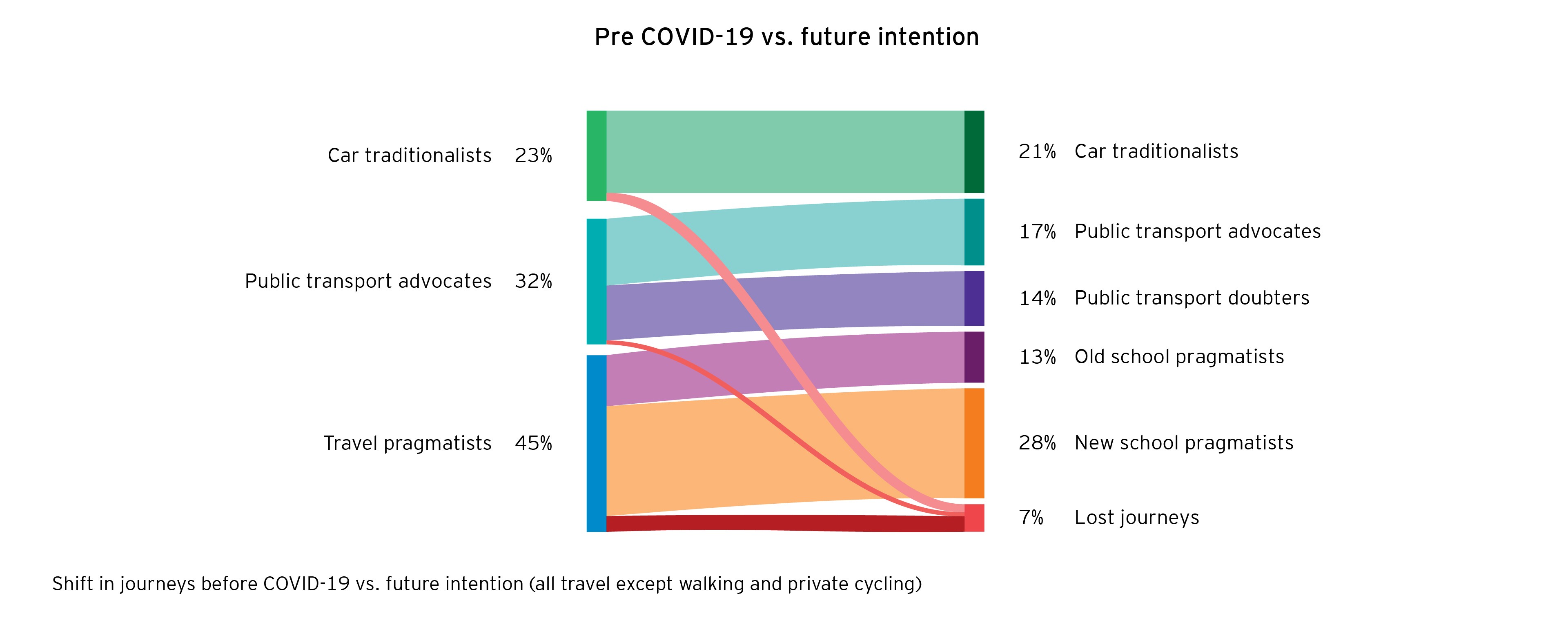

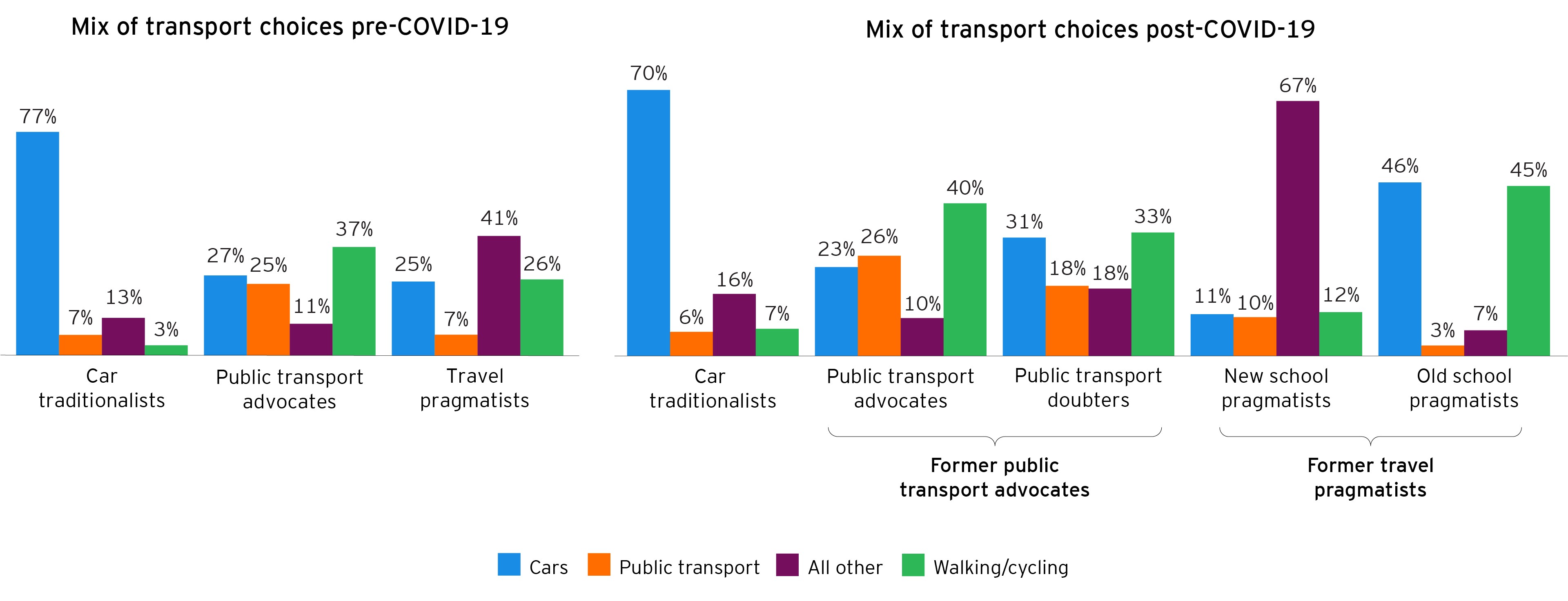

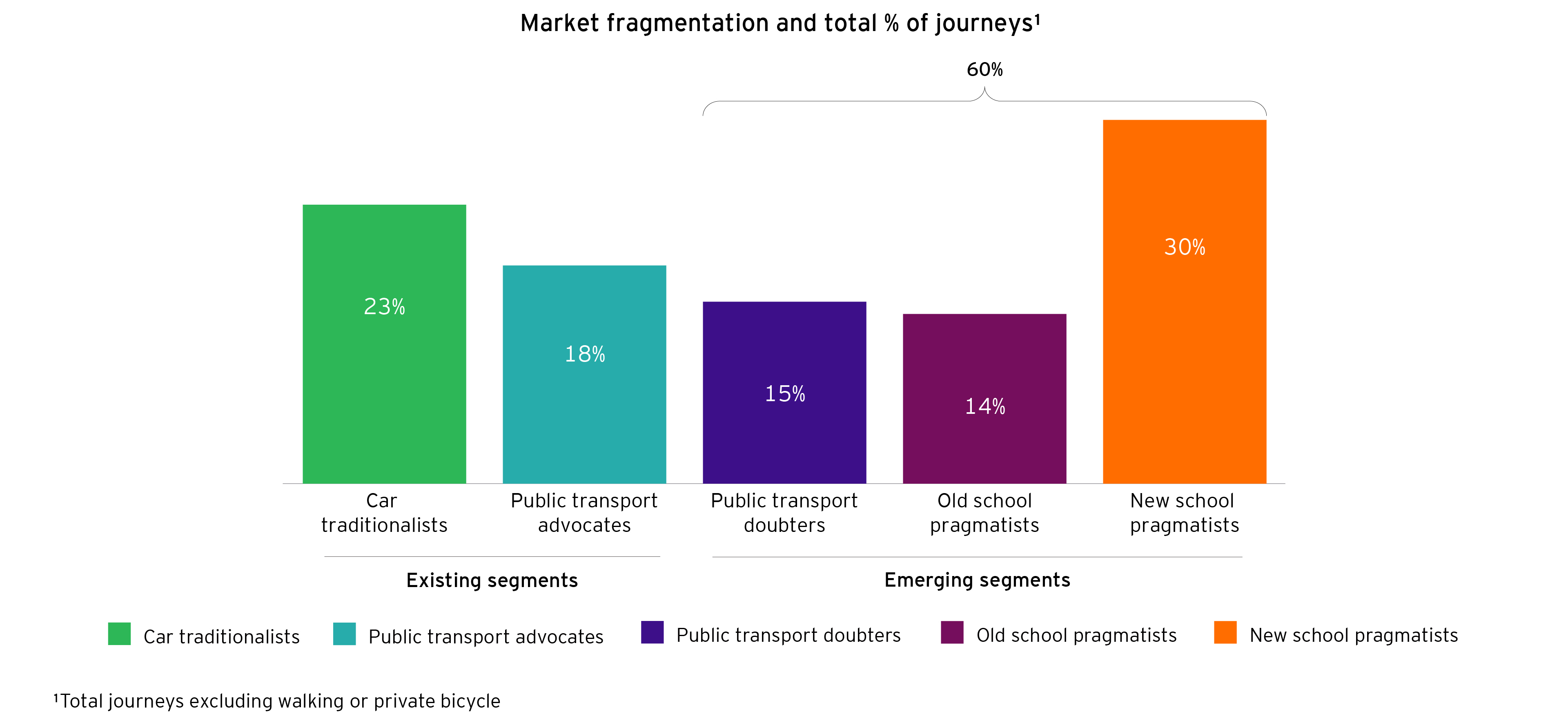

Some consumers now appear more interested in car ownership than before COVID-19. Hygiene concerns, previously relatively trivial, are now an important criterion in determining travel patterns, especially for Old School Pragmatists. Public Transport Doubters have similar needs but are generally less wealthy and more environmentally conscious. New School Pragmatists are open to cars, but they are also open to everything else.

The challenge for the automotive industry is to adapt to serve these three emerging segments of Public Transport Doubters and Old and New School Pragmatists: they value flexibility and are unlikely to use cars as often, or be as loyal, as Car Traditionalists. Business models with fewer commitments, incorporating electric and used cars to reduce costs and burnish environmental credentials, may appeal to them. The industry must discover how offerings can become broader and take care of many of unwanted ownership headaches, especially those newly created by electric vehicles.

Challenges for public transport

Both Public Transport Doubters and Old School Pragmatists plan to reduce their work-related public transport usage by around 30% and 55% respectively. Whilst New School Pragmatists remain receptive, public transport rarely provides integration with other transport modes they frequently use. Overall, UK public transport use for all journey types is expected to decrease by 12%, through a combination of reduced work-related travel and hygiene concerns. The normal remedies to falling revenues are unpalatable: increased subsidies and price rises.

Although carnet-like flexible season tickets loaded to smart cards make life easier for customers, they do not fix operational problems such as the viability of scheduled services where high capacity utilisation is key to efficiency. They may also be insufficiently flexible if they are prescriptive about the quantity of trips within a given period or have fixed destinations.

To solve these problems, operators must first understand how demand has changed, and compensate through a review of existing timetables and improved efficiency, for example real-time capacity planning, at an individual train level, using movement and other data to augment live ticket sales in dynamically predicting demand before passengers arrive on the platform. The longer-term outlook is unclear: will COVID-19 concerns fade away in a few years? Will capacity reduction result in a smaller yet still viable sector? Or, does public transport need to integrate with other services, perhaps as part of a multi-modal ecosystem, to remain relevant?

The rise of mobility-as-a-service operators

The term mobility-as-a-service covers a new breed of service operators ranging from ride-hailing companies to electric scooter rental firms and even some existing players who are repackaging established products, such as car leasing and insurance, into all-inclusive offerings combined with more flexible payment terms. Often, they combine transport modes to cater for a variety of journeys.

New School Pragmatists are clearly open to mobility-as-a-service. This ready-made group of potential early adopters want flexibility and are happy to experiment. They are also relatively rich, so successful products do not necessarily have to be cheap. Public Transport Doubters and Old School Pragmatists are wary of technology and must be persuaded to trust it; their travel profiles suggest they should be interested in mobility services.

What are the implications for government policy?

Government’s strategy for ever-expanding bus, train and tram usage is being challenged, as consumers choose alternatives. Reductions in public transport usage triggered by COVID-19 threaten environmental policies and potentially increase the need for subsidies to keep operators viable. Although public transport will remain a key part of travel mix, the Public Transport Doubters and Old School Pragmatists are seeking alternatives that deliver greater flexibility. Perspectives do appear to be changing with the wider acceptance of electric vehicles and broader use of clean energy to build and power cars. As a result, private cars can arguably be positioned as a more environmentally friendly choice. This should force a fundamental rethink about the ideal transport mix, and how to encourage it.

Some government initiatives already fit the trend indicated by the consumer data. For instance, the highway code is being rewritten to give more priority to pedestrians and cyclists -- travel choices which appeal to all consumers, except Car Traditionalists. Some problems are substantial: if intercity public transport loses popularity, an additional alternative to private cars is required.

A call to action for transport providers and policymakers

Through our analysis of the consumer trends identified in the MCI data, we have developed six calls to action for transport product and service providers and government:

- Build integrated travel demand models, with incentives that actively align demand and supply across the future travel service portfolio

- Develop data analysis tools to assess and manage the full travel needs of customers in terms of usage and geography

- Build formal coalitions of the critical industries (automotive, energy, finance, infrastructure and technology) to create new services that deliver flexibility for customers and fairly align responsibilities and revenues

- Test the different service alternatives in pilot trials with representative customers to pick winning solutions

- Build platforms that can be deployed at scale and tailored to different geographic and social situations

- Educate customers and policymakers about the options and benefits of the new transport services